Uncategorized

Understanding Housing Affordability in Today’s Market

Understanding Housing Affordability in Today’s Market The ongoing housing affordability crisis across the country is having a significant impact on how a large portion of Americans are living, budgeting and planning for their futures. With a nationwide shortage of approximately 1.5 million housing units, home prices and rent have both increased — up 26% and 47%, respectively, since…

Read MoreFraming Lumber Prices

Framing Lumber Prices NAHB continually tracks the latest lumber prices and futures prices, and provides an overview of the behaviors within the U.S. framing lumber market. The information is sourced each week using the Random Lengths Framing Lumber Composite which is comprised using prices from the highest volume-producing regions of the U.S. and Canada. A…

Read MoreShare of Young Adults Living With Their Parents Drops to Decade Low

Share of Young Adults Living With Their Parents Drops to Decade Low Despite record high inflation rates, rising interest rates and worsening housing affordability, young adults continued to move out of parental homes in 2022. According to NAHB’s analysis of the 2022 American Community Survey (ACS) Public Use Microdata Sample (PUMS), the share of young…

Read MoreAmidst Housing Slowdown, Exurban Areas Post Largest Construction Gains

Amidst Housing Slowdown, Exurban Areas Post Largest Construction Gains For the third consecutive quarter, single-family growth rates were negative for all geographic sectors of the nation, as exurban areas posted the largest increase in market share for both single-family and multifamily construction, according to the latest findings from the National Association of Home Builders (NAHB)…

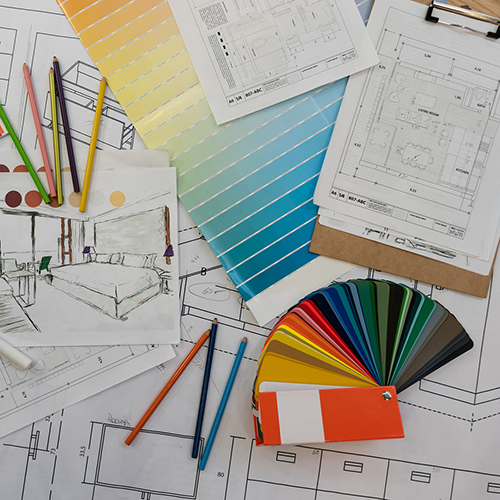

Read MoreWhat Design Trends Will Have Staying Power in 2024?

What Design Trends Will Have Staying Power in 2024? For remodelers looking to elevate their businesses in the new year, staying on top of the latest housing trends is a must. In this installment of NAHB’s Remodeling Forecasts, Myths & Trends video series, sponsored by Lowe’s Pro, Pro Remodeler’s managing editor Caroline Broderick digs into which home…

Read MoreIn a Win for NAHB, Congress Extends Funding for NFIP

In a Win for NAHB, Congress Extends Funding for NFIP With the National Flood Insurance Program (NFIP) and federal government 48 hours away from a funding lapse, House and Senate lawmakers acted in a bipartisan manner to fund the operations of the federal government, including the NFIP, through early next year. NAHB has been at…

Read MoreRising Mortgage Rates Push Housing Affordability to Lowest Level in Index History

Rising Mortgage Rates Push Housing Affordability to Lowest Level in Index History Rising mortgage rates, elevated construction costs and limited existing inventory helped push housing affordability in the third quarter of 2023 to its lowest level in more than a decade. According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI),…

Read MoreNAHB Opposes H-2B Bill that Targets the Construction Industry

NAHB Opposes H-2B Bill that Targets the Construction Industry In a pre-emptive move, NAHB has joined a group of 11 other leading organizations in the construction industry to send a letter to Senate and House leaders that strongly opposes pending legislation by Sens. Lindsey Graham (R-S.C.) and Alex Padilla (D-Calif.) that would impose harmful and…

Read MoreLack of Resales Boost New Home Sales in September

Lack of Resales Boost New Home Sales in September Despite mortgage rates that are at a 23-year high, new home sales posted a double-digit percentage gain in September because of a lack of inventory in the resale market. Sales of newly built, single-family homes in September increased 12.3% to a 759,000 seasonally adjusted annual rate,…

Read MoreFed Chairman Signals a Possible Pause on Rate Hikes

Fed Chairman Signals a Possible Pause on Rate Hikes In a positive development for NAHB and the housing industry, Federal Reserve Chairman Jerome Powell has signaled that the central bank is unlikely to raise rates further unless clear signs emerge that strong economic growth could trigger a rise in inflation. As reported by the Wall…

Read More